Tips For a Smoother Braintree Payments Approval Process

Applying for a merchant account can seem complex and intimidating, especially if it’s your first time. Braintree Payments evaluates you and your marketplace with the largest of magnifying glasses because they must assess and minimize their risk before entering into a partnership. Braintree supports a lot of large marketplaces like Airbnb and Upwork, and they’re very selective on whom they approve. They typically only approve about 10% of applicants. So, let’s dig in on how to get approved by Braintree.

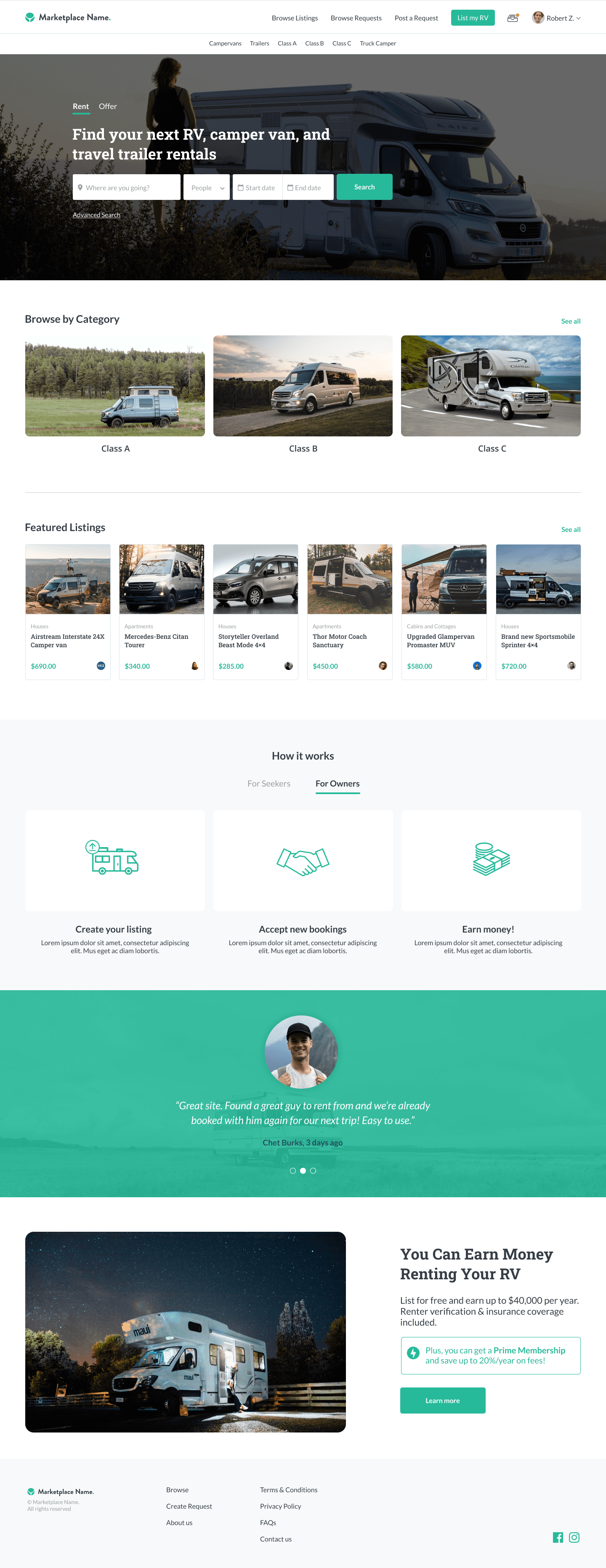

Braintree and MPB are not affiliated in any way, but we integrate our clients with that gateway as our preferred choice. The main reason is to make the transaction process easier for marketplace owners as often staff is minimal in the early days. Another reason they’re our preferred payment processor, and beneficial to our clients, is because they only charge one processing fee, while all payments technically touch three accounts. All payments go to the marketplace first, then those funds are distributed to the seller or service provider often with a transaction fee taken before the sub-merchant is paid.

As part of the application process, Braintree will send you a list of questions to gather more details about your specific marketplace. These questions may seem complex, but don’t let them scare you. Below, I’ve provided some helpful tips and tricks on how to get approved by Braintree.

- In order for any payment processor to approve you or extend a line of credit for your business, they’ll want to make sure you’re running a legitimate, and potentially profitable business. Braintree will ask you to provide your articles of incorporation, sometimes called a certificate of formation or a charter. They are a set of documents filed with a government body to legally document the creation of your corporation.

- Think of Braintree as a bank extending you a line of credit to be your marketplace payment processor. The best way to increase the likelihood of getting approved is by providing them with a narrow, single-focused explanation of your marketplace. The broader the explanation, and the more verticals you explain, the more unknowns there are which they’ll see as risky, meaning there’d be less of a chance of you getting approved. They like single verticals.

- An example of a narrow, single-focused, and single vertical is this: Think about how Amazon started. They began by just selling books; that’s just one vertical. Obviously, Amazon had plans to scale and expand, however they wouldn’t have told their bank or payment processor this information when applying because the success of their planned growth would be unknown at that time. Unknowns are risky to payment processors, just like banks. MPB likes to know your long-term business plans because we are going to build it for you, BT only needs to know that you are serious, have a narrow focus, and will bring them money every month.

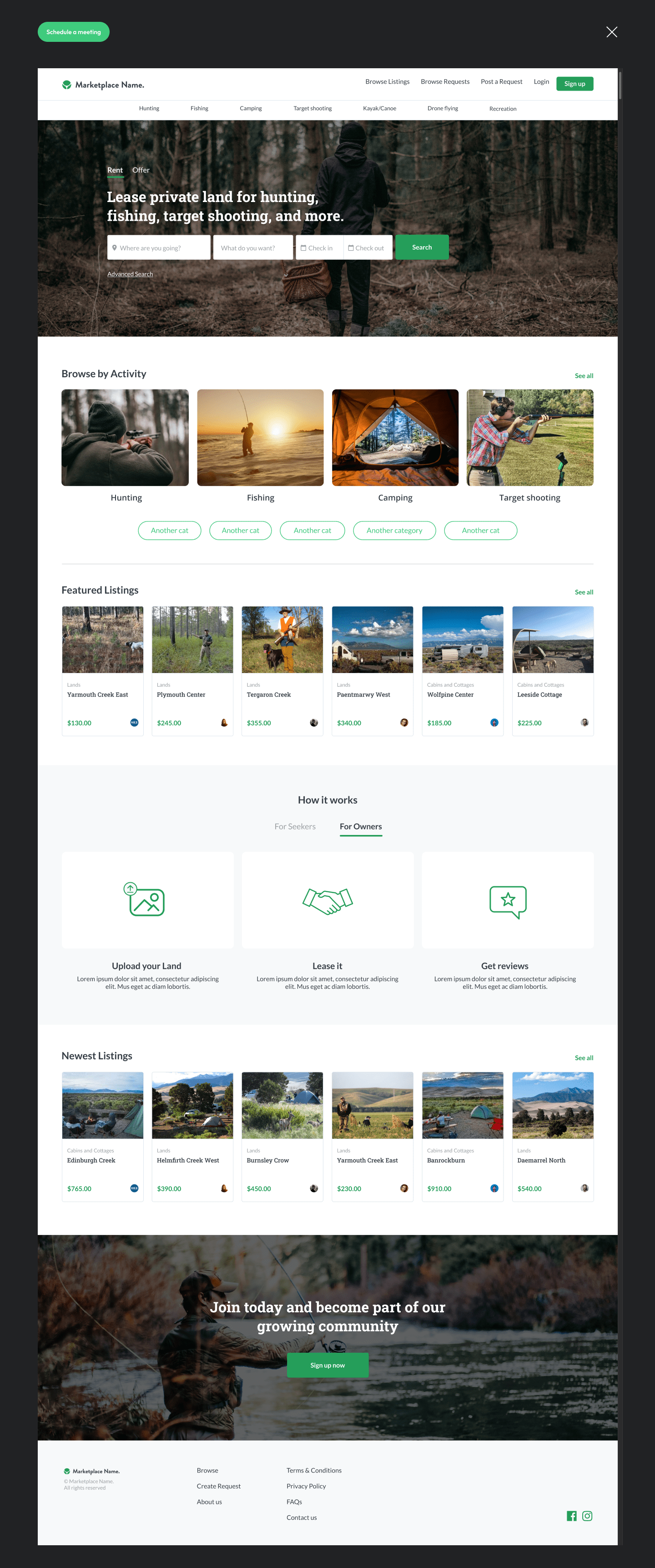

- For the sole purpose of getting Braintree to approve you when describing your marketplace, it’s best to stick to explaining one vertical (product or service) and only 2-3 of your categories. For example, let’s say your marketplace will be providing animal grooming services and also pet walking and care. To increase your chances of getting approved, the best description would be: My marketplace will provide pet grooming services (one vertical). Grooming services will be offered for Dogs and Cats (2 categories). In this case, your sub-merchants, (service providers) will be dog and cat groomers.

- Braintree will ask what information you’re collecting to validate product providers/service providers and how you’re making sure the information they provide is legitimate because again, they want to avoid any unknowns that could potentially become costly. Let’s say one of your service providers on your marketplace is continuously doing unsatisfactory work on costly services of $10,000 causing the buyers to request refunds. This is not good for Braintree as a company since they’ll be forced to continuously refund large sums of money due to the displeasing service provider on your marketplace.

- The best way to answer these questions about your sub-merchant vetting process so that Braintree will approve you is by explaining to them that the product providers or service providers on your marketplace have been hand-selected by you and are part of your community. Or are legitimate businesses in your local area (service site)? You know they are legitimate because they are active members of the community where they conduct their individual service/product businesses. You are providing them with an online presence with this marketplace you’re creating. If they are product sellers you may want to upgrade the admin panel to have to manually “verify” users before you let them join. This is a small fee from us but drastically decreases your risk of letting in illegitimate businesses. To BT you can mention that you have to “verify” the users before they’re allowed to offer products or services, which they will like.

- Braintree will ask how you’re going to determine if the transaction was completed satisfactorily between your service/product provider and the buyer. This is also to make sure continuous refunds won’t be an issue on your marketplace. You’ll want to explain that confirmation of the service or product purchase will be required before the date of service or before the product is shipped between the seller and the buyer. Confirmation will also be required after the service has been complete or once the product has been delivered.

- Another tricky question that Braintree may ask is if the entire cardholder’s purchase experience will be conducted on your website and not that of another entity. They’re asking if all transactions, so any money that the product/service seeker is paying the product/service provider will only go through your marketplace. They want to make sure money isn’t being swept under the rug outside of your marketplace for services or products being sold on your marketplace. So, your answer would be: “Yes, the entire cardholder purchase experience will be conducted on my website”.

- Finally, only provide information that you already know. Don’t discuss what your future dreams or plans are for your marketplace or how you’re going to make it grow. Those are details you can and should talk to us about. Remember, the more unknowns you pose, the riskier you appear to Braintree.

If you do not get approved for Braintree Payments, then you will have to use a different processor and may be subject to additional fees on each transaction in your marketplace. Other merchant processors do not offer the same rates, they are all subject to variations as independent businesses. We simply want to ensure our clients all work with a processor that allows for middleman transactions/marketplace transactions or split payments. Even if this isn’t a model you intend on utilizing initially (in case your site is a B2B Subscription model), you may eventually want the functionality so we prefer to choose processors that allow for the technical aspects of this model. There aren’t a lot of marketplace processing options on the market currently, but the available ones are all reputable and large companies. If you aren’t interested in playing middle man or taking payments through the site, not a problem, Braintree is still a great option.